Upon hearing the term “passive income,” one might initially envision a luxurious lifestyle surrounded by palm trees. However, upon further consideration, one may acknowledge the dubious nature of exaggerated claims such as “earn $10,000 in the next week,” which can undermine the reliability of passive income.

By working with intention and putting in the effort, it is possible to escape the time-for-money exchange, even though passive income is not a definite success.

What is passive income?

Passive income allows you to earn an income without directly exchanging time for money, and although it requires some effort, it provides a means of maximizing earnings while minimizing the amount of work needed.

There are a few things to keep in mind before diving into how to generate passive income.

If you have experience in a specific topic or industry, it is advisable to start by rephrasing information related to it. This can make the process of thinking step by step easier. However, if your skills or interests do not match any of the passive income ideas mentioned below, there is no need to worry. You can refer to our guide on low-cost business ideas, which offers various ways to earn money and have greater control over your work. Remember, the goal is to maintain the same meaning while rephrasing the text.

Automate. Both automation and passive income aim to accomplish more tasks within a shorter duration. For instance, Manfred utilizes Zapier to automatically transfer new supplement orders to his third-party supplier. As a result, automations and dropshippers take care of all the steps involved in fulfilling online sales.

If passive income was easy or guaranteed to work, everyone would be doing it. Most income isn’t passive for a reason. Therefore, it is important to approach it with a realistic mindset and acknowledge that there won’t always be a pot of gold waiting at the end of the passive rainbow.

examples of passive income

As we delve into several methods of generating passive income, use them as a source of inspiration for your personal ventures. Although you are encouraged to experiment with one of these passive income streams, the primary objective is to impart knowledge about different types of businesses and investments, and the common traits they possess, in order to stimulate your creativity.

1. Rent out your car

Assuming you already own a car, the overhead investment is low.

If you don’t reside in a neighborhood that is easy to traverse on foot, owning a car is necessary for carrying out essential tasks. However, if you are among the vast number of individuals who are employed remotely for at least a portion of their working hours, chances are your car usage has decreased compared to the past.

Paul Sundin, CEO of Emparion, explained to me that by participating in car-sharing, individuals can have their vehicles listed on a car-sharing marketplace. This allows them to access a local market of car renters. After meeting the platform’s requirements for listing approval, individuals can enjoy the benefits of a car renting service.

If you are willing and capable of utilizing this passive income stream, allowing individuals to borrow your car for short-term rentals can reportedly yield several hundred dollars per month. By doing so, you could potentially cover a portion or the entirety of your monthly car expenses.

2. Sell an online course

Medium overhead investment is required. Although you will require some tools, the primary investment needed is your time to get started.

Stefan Palios earns passive income by sharing his knowledge if he possesses unique skills or experiences.

“I currently have two passive income sources—both small right now, but entirely passive: My book, The 50 Laws of Freelancing (through Amazon) and my course, How to Find Freelance Clients Using Twitter (through Udemy). The marketplace element is what makes this passive income. Amazon markets and sells my book, and Udemy markets and sells my courses. Now, this isn’t a life-changing income (yet!). But I published the book in 2020, and it still pays me monthly. The course is new, but I created it relatively quickly, so the time ROI is good.”

3. Start a blog

The investment required for overhead is moderate. Although some tools are necessary, the primary requirement for getting started is investing time.

Megan Jones started her travel blog, Traveller’s Elixir, two and a half years ago. She mentioned that after dedicating a year and a half to it, she was able to quit her job. Megan mentioned that her website now receives over 160,000 monthly visitors, allowing her to generate passive income on a daily basis.

4. Invest in rental properties

To make an overhead investment, you will either require funds for purchasing the property or need to make arrangements for financing.

Investing in real estate may not be a feasible choice for the majority of individuals, but it remains a reliable method to increase wealth and is considered one of the finest forms of passive income investments, especially for those with available funds. Michael Green, who owns Quick Cash Homebuyers, personally witnesses the advantages of real estate investing.

“Thanks to my real estate expertise, I have been able to find and purchase affordable rental properties in different parts of the country, which I then lease out to trustworthy tenants. By building a healthy rental portfolio, I enjoy steady passive income each month without fail. After removing repair and maintenance allocation plus taxes, I’m still left with a significant portion as profit from my investments for me to re-invest in other passive income generation activities.”

If you have an interest in rental properties but are not yet ready to add them to your portfolio, one option is to begin by renting out an additional bedroom. Alternatively, if you have future plans to make a purchase, you can consider buying a duplex and renting out one half while residing in the other.

5. Try dropshipping

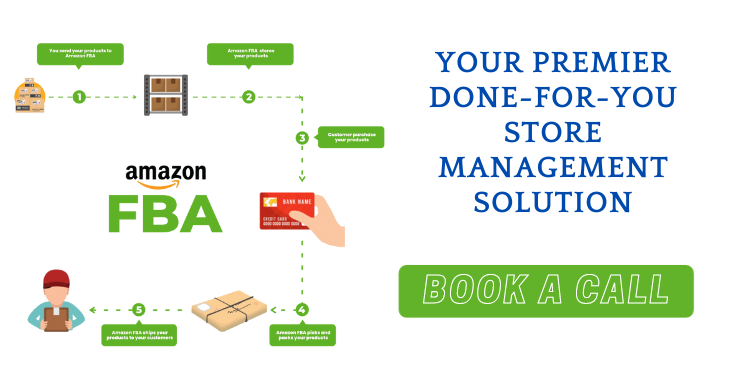

Dropshipping is an inventory-free method of operating an online store, where customers make purchases from your store and a third party fulfills the product shipment. If you hire someone to handle day-to-day operations, it can become a less involved approach.

6. Sleep studies or surveys

Taking part in a medical sleep study can sometimes offer a novel way to earn money while you sleep, providing an entirely different concept of financial gain.

While conducting a study, an individual responsible for technical tasks observes the activity occurring within your brain.

Participating in each study may come with certain requirements, yet it can be one of the most effective methods to earn money with minimal exertion.

7. Rent out storage space

Do you require additional funds and possess unused space in your basement or garage? You have the option to lease out this surplus space to individuals for storing their belongings.

Even your unused space can serve as a source of income, helping you to cover your mortgage expenses, or at least a portion of them!

8. Create apps or software to sell

If you already possess technical skills, consider devising a program that could enhance the quality of people’s lives or offer them enjoyment. It is important to note that even uncomplicated applications have the potential to achieve success.

Consider the story of Flappy Bird as an example: this game was extremely simple, but it became addictive and achieved viral popularity, resulting in its creator earning $50,000 per day from ad revenue.

The Flappy Bird story is not a typical case, but it illustrates that you can make a profit without creating the most extravagant and intricate apps.

9. Publish eBooks

One popular method of earning money from fiction or nonfiction writing is by self-publishing books on Kindle. The process involves dedicating a significant amount of time and effort to writing the book, making it a top choice for generating passive income. Additionally, promoting the book is essential to inform readers about its availability.

Once you have completed that task, you can relax and generate sales. Over time, the profits can accumulate as customers continue to purchase copies for many years.

10. Buy bonds and/or Certificates of Deposit

Bonds and CDs (certificates of deposit) are among the most secure passive income streams, but in exchange, they typically provide relatively low returns and require a specific time commitment for your money.

How to passively make $2,000 a month?

By combining several passive income ideas, you can achieve the goal of earning $2,000 per month or $500 per week without any active effort on your part.

To increase your chances of consistently making a couple of thousand dollars, consider engaging in two high-earning endeavors such as selling a self-created product or an affiliate product, stock market investing, or engaging in real estate rentals alongside stock market investing.

How to make $5,000 a month passively?

To increase your earnings, it is advised to consider multiple ideas that have the potential for higher income in the long run.

In order to achieve a monthly passive income of $5,000, it is probable that you will need to combine two or even three passive income sources. Examples of such sources include commencing a blog, engaging in affiliate marketing, making real estate investments, and investing in the stock market, among others.

Leave a Reply